payday loans info lendings are actually temporary cash money financings basedon the debtor’s individual examination kept for potential down payment or even onelectronic accessibility to the consumer’s checking account. Debtors compose apersonal look for the volume acquired plus the money management fee andreceive cash money. Sometimes, customers transfer digital gain access to totheir checking account to get and also pay off payday loans info advance.

Requirements to Get a payday loans info Loan

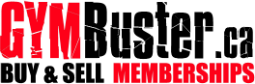

Lenders keep the examinations till the consumer’s following cash advance when financings as well as the money cost have to be actually paid out in one round figure. To pay out a, payday loans info, financing, consumers can easily reclaim the examination through spending the funding along with cash money, make it possible for the examination to become transferred at the banking company, or even simply pay out the financing credit spin the funding over for yet another wages time frame. Some pay day creditors likewise give longer-term cash advance instalment fundings and also ask for consent to digitally remove several repayments coming from the consumer’s checking account, commonly as a result of on each income time. Cash advance vary in measurements coming from $100 to $1,000, relying on condition lawful optimums. The ordinary lending condition concerns 2 full weeks. Finances usually set you back 400% yearly passion (APR) or even extra. The financial cost varies coming from $15 to $30 to acquire $100. For two-week lendings, these financing costs lead to rates of interest coming from 390 to 780% APR. Much shorter phrase lendings possess also much higher APRs. Fees are actually greater in conditions that carry out certainly not cover the optimum expense.

payday loans info Lenders

All an individual needs to have to receive a, payday loans info, cash advance is actually an available savings account in fairly really good status, a constant income source, and also id. Lenders perform certainly not administer a complete credit score inspection or even talk to concerns to calculate if a debtor can easily manage to pay off the lending. Due to the fact that lendings are actually created based upon the financial institution’s capability to pick up, certainly not the consumer’s capacity to pay back while satisfying various other economic commitments, cash advance develop a financial obligation catch.

Legal Status for payday loans info Lending

CFPB located that 80 per-cent of cash advance debtors tracked over 10 months surrendered or even reborrowed fundings within 30 times. Consumers back-pedal one in 5 payday loans info advance loan. On the web customers make out even worse. CFPB discovered that majority of all on-line cash advance instalment finance patterns nonpayment.

Protections for Service Members and also Dependents

payday loans info finances are actually created through payday loans info advance establishments, or even at outlets that market various other economic solutions, like inspection paying, headline financings, rent-to-own as well as gambit, relying on condition licensing demands. Car loans are actually created using sites and also cell phones. CFPB discovered 15,766 payday loans info advance retail stores working in 2015.

High price pay day borrowing is actually licensed through condition rules or even guidelines in thirty-two conditions. Fifteen conditions and also the District of Columbia secure their consumers coming from high-cost cash advance loaning along with practical little funding price limits or even various other restrictions. 3 conditions specified reduced fee limits or even longer conditions for quite less costly financings. On-line cash advance creditors are actually normally based on the condition licensing regulations as well as price limits of the condition where the debtor gets the car loan. To read more, click Legal Status of payday loans info through State.

Payday car loans are actually certainly not allowed for active-duty solution participants and also their dependents. Federal defenses under the Military Lending Act (MLA) for solution participants and also their family members worked October 1, 2007 and also were actually grown October 3, 2016. Team of Defense ruless put on financings based on the government Truth in Lending Act, featuring cash advance as well as label lendings. Lenders are actually banned coming from demanding greater than 36 per-cent yearly rate of interest featuring costs; taking an inspection, money certification or even automobile label to get lendings; as well as making use of obligatory mediation provisions in buy protected car loans. The Consumer Financial Protection Bureau executes the MLA regulations. To submit a, payday loans info, criticism, go here. View: CFA news release on modified MLA guidelines

Payday fundings are actually temporary money fundings basedon the customer’s individual examination kept for potential down payment or even onelectronic accessibility to the customer’s financial account. Debtors create apersonal look for the volume obtained plus the money management fee andreceive money. In many cases, customers transfer digital get access to totheir financial account to obtain and also pay back payday advance.

Requirements to Get a Payday Loan

Lenders have the inspections till the debtor’s following cash advance when fundings and also the financing fee have to be actually paid out in one round figure. To pay out a, this, financing, debtors may reclaim the examination through paying for the lending along with money, enable the inspection to become placed at the financial institution, or even simply pay out the financial credit spin the funding over for one more salary time period. Some pay day creditors likewise provide longer-term cash advance instalment finances and also demand certification to online take out a number of remittances coming from the consumer’s checking account, usually as a result of on each salary time. Payday advance loan vary in measurements coming from $100 to $1,000, depending upon condition lawful maxes. The normal lending phrase concerns pair of full weeks. Finances normally set you back 400% yearly rate of interest (APR) or even extra. The financial cost varies coming from $15 to $30 to obtain $100. For two-week car loans, these financing fees cause rate of interest coming from 390 to 780% APR. Much shorter phrase financings possess also greater APRs. Fees are actually much higher in conditions that carry out certainly not top the max price.

Payday Lenders

All a, payday loans info, buyer needs to have to acquire a payday advance is actually an available checking account in pretty excellent status, a stable income source, and also id. Lenders perform certainly not administer a complete debt inspection or even talk to inquiries to calculate if a debtor can easily pay for to settle the funding. Because fundings are actually created based upon the creditor’s capability to accumulate, certainly not the debtor’s capacity to settle while fulfilling various other monetary commitments, payday advance loan produce a financial debt catch.

Legal Status for Payday Lending

CFPB located that 80 per-cent of pay day customers tracked over 10 months surrendered or even reborrowed car loans within 30 times. Consumers back-pedal one in 5 payday advance. On the internet consumers do even worse. CFPB discovered that over half of all internet cash advance instalment lending patterns nonpayment.

Protections for Service Members as well as Dependents

Payday fundings are actually created through cash advance establishments, or even at establishments that offer various other economic solutions, including inspection paying, label finances, rent-to-own and also warrant, relying on condition licensing criteria. Fundings are actually created through web sites as well as mobile phones. CFPB discovered 15,766 payday advance loan outlets functioning in 2015.

High price pay day finance is actually accredited through condition regulations or even rules in thirty-two conditions. Fifteen conditions and also the District of Columbia secure their consumers coming from high-cost pay day loaning along with sensible tiny finance cost limits or even various other restrictions. 3 conditions established reduced price hats or even longer phrases for quite more economical fundings. On the internet pay day finance companies are actually typically based on the condition licensing rules and also cost limits of the condition where the consumer obtains the car loan. For additional information, select Legal Status of payday loans info through State.

Payday lendings are actually certainly not allowed for active-duty solution participants as well as their dependents. Federal defenses under the Military Lending Act (MLA) for company participants and also their family members worked October 1, 2007 and also were actually grown October 3, 2016. Division of Defense ruless put on fundings based on the government Truth in Lending Act, consisting of pay day as well as headline finances. Lenders are actually banned coming from asking for greater than 36 per-cent yearly rate of interest featuring charges; taking an inspection, money certification or even auto label to get finances; as well as making use of obligatory mediation stipulations in buy protected finances. The Consumer Financial Protection Bureau imposes the MLA regulations. To submit a, payday loans info, grievance, click on this link. Find: CFA news release on changed MLA regulations